How to Read a W-2 Form: Essential Guide for Understanding Your 2025 Taxes

Understanding your W-2 form is crucial for accurate tax filing and ensuring that you receive the tax benefits you are entitled to. In this guide, we break down the process of interpreting a W-2 form, discussing everything from W-2 content explained to its overall importance in your tax return process. Let’s dive into how to read a W-2 form effectively to make filing your 2025 taxes smooth and efficient.

Understanding the W-2 Form Layout

The first step in understanding your W-2 is familiarizing yourself with its layout. Typically, a W-2 form consists of several boxes that contain essential information regarding your income and withholdings. The **W-2 form sections** include employee details, employer details, income information, and various tax withholdings. Each of these sections plays a critical role in providing a comprehensive overview of your earnings for the tax year.

Key Components of the W-2

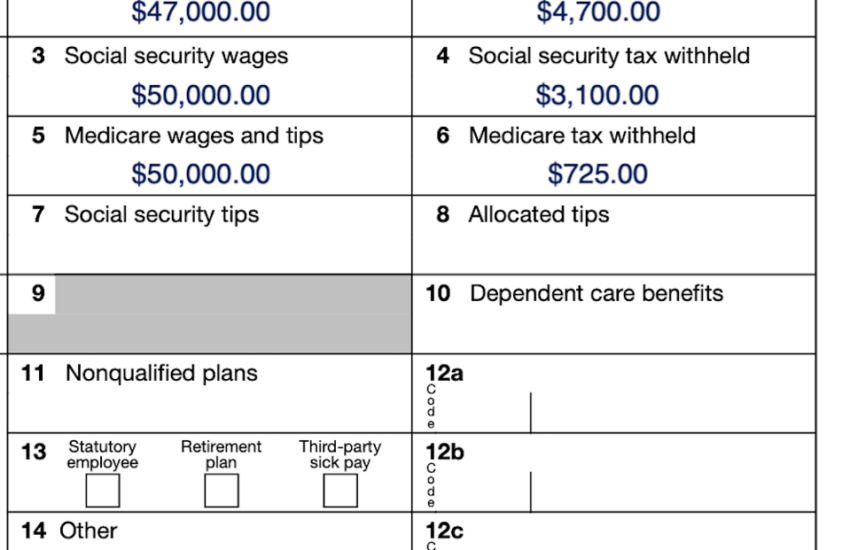

Within the W-2 form layout, you’ll find important details in boxes labeled typically from 1 through 20. Each box serves a specific purpose. For example, Box 1 shows your total taxable wages, Box 2 indicates federal tax withheld, while Boxes 3 and 4 refer to Social Security wages and withheld amounts respectively. Understanding these numbers is key to **identifying income on a W-2**, as they determine what income you’ll report on your tax return and how much taxes you’ve already paid.

What Each Box Represents

The significance of **understanding box numbers on W-2** cannot be overstated. Each box conveys critical information relevant to your tax status. For instance, Box 12 can include various codes that represent additional tax information such as retirement contributions or the use of employer-provided benefits. This diverse information plays a crucial role when you are filing taxes with your W-2, ensuring accuracy in your declarations and potentially maximizing tax refunds.

W-2 Content Explained: Tax Implications

Understanding **tax information on W-2** forms is essential for both average employees and self-employed individuals. W-2s elucidate your tax liabilities and benefits. For instance, the amounts reflected in the tax withholdings may significantly impact whether you owe taxes or receive a refund. It’s vital to familiarize yourself with this information well before filing deadlines to prevent surprises when your return is processed.

Reading W-2 Earnings: Gross vs. Net Income

A common point of confusion for many is the difference between gross income and net income as shown on the W-2. Gross income, typically reflected in Box 1, does not account for deductions while net income may reflect your take-home pay. Understanding this difference can greatly affect your tax calculations and obligations, especially on self-employment income reported on a W-2, ensuring you pay the right taxes.

Understanding W-2 Deductions

**Understanding W-2 deductions** is crucial as they can majorly affect your tax refund amount. Frequent deductions include those for retirement plans, health insurance premiums, and health accounts. Familiarity with these deductions ensures you’re aware of what expenses have already been accounted for and helps deduce any additional items you may claim on your tax return.

Common Mistakes When Reading W-2s

When it comes to **common mistakes with W-2 forms**, one of the most significant errors is misunderstanding the entries within. Incorrectly entering amounts or neglecting to recognize certain box values can lead to tax discrepancies. It’s vital to double-check the information for accuracy and completeness before submission to avoid potential audits or penalties from the IRS.

W-2 Corrections and Reporting Errors

If you suspect an **income error** on your W-2, contacting your employer is the best first step. Inaccuracies must be corrected using a W-2c (corrected W-2). Timely handling of this ensures proper reporting to the IRS, thereby minimizing the chances of complications during the tax preparation phase. This care is critical, particularly if you file E-file with your W-2, as the digital submission data needs to align precisely with tax information provided to the IRS.

Tips for an Accurate Submission

To help avoid misreporting, review these vital tips for **reading W-2** forms correctly:

- Ensure names and Social Security numbers are accurate.

- Check each box for correct reporting with your company records.

- Note any additional income not included to give an accurate full picture.

- If applicable, verify specifics around state taxes and discuss with your accountant.

Being diligent with these steps will ultimately lead to a more successful tax preparation experience.

Accessing and Storing Your W-2 Records

In today’s digital age, accessing your W-2 online has become increasingly common. Following your employer’s practices is key; many now offer **digital W-2 records** in addition to printed formats. Before accessing, check employer policies and data security for your peace of mind. This convenience simplifies tax preparation and enables easy backing up in personal finance records.

How to Obtain a Replacement W-2

If your W-2 is lost or damaged, you can request a replacement from your employer. This should be done as soon as possible to ensure no complications arise by the tax filing deadline. If your employer is unresponsive or unhelpful, consider reaching out to the IRS as they may assist in the process. Understanding the **timeline for receiving W-2** forms is equally crucial, as employers are mandated to issue these by January 31st following the tax year.

W-2 Forms for Freelancers

While **W-2 forms for freelancers** are less common, understanding tax implications remains vital. Freelancers or independent contractors typically receive Form 1099 instead, which can create additional complexities during tax filing. Those who have reason to receive a W-2 through partial employment need to ensure that workers’ compensation and income reflect accurately the time worked to avoid tax hassles.

Conclusion

<p grasping how to read a W-2 form ensures your tax filing experience stays stress-free. By understanding the layout, identifying key content, and avoiding common mistakes, you will navigate your tax obligations competently. As we look toward tax season, make certain your taxes run smoothly by equipping yourself with knowledge about your W-2 form.

Key Takeaways

- Know the layout of the W-2 to easily identify critical tax information.

- Acknowledge deductions that could impact your refund and taxes owed.

- Be aware of common errors and how to handle corrections for smooth filing.

- Access your W-2 records digitally when possible for added convenience.

- Understand the nuances between W-2 and 1099 rules especially for freelancers.

FAQ

1. What should I do if I find an error on my W-2?

If you spot an error on your W-2, notify your employer immediately. They will provide you with a corrected W-2c form to ensure proper reporting to the IRS. This is essential to avoid penalties and inaccuracies in your submitted tax return.

2. When will I receive my W-2?

Your employer should provide your W-2 form by January 31 following the tax year. If you haven’t received it by mid-February, contact your employer to inquire about its status as this could affect your ability to file taxes on time.

3. Can I access my W-2 online?

Many employers now offer **W-2 online access** to facilitate convenient retrieval of your form. Check your employer’s instructions or employee portal for options to download or view your W-2 electronically.

4. What is the difference between a W-2 and a 1099?

A W-2 is used to report wages and withheld taxes for employees, while a 1099 is issued to independent contractors and freelancers to report payments made during the year without taxes withheld. Understanding these differences is important for accurate tax reporting.

5. How do state taxes work with a W-2?

State taxes are typically withheld from your paycheck and reported in Box 17 on the W-2. Always double-check the amount listed, as inaccuracies can result in owing state taxes when you file or, conversely, in receiving refunds.